Gold (XAU/USD) Price Analysis and Chart

- Gold rallies after US data miss.

- Gold trades in heavily overbought territory.

Learn how to trade gold with our complimentary trading guide

Recommended by Nick Cawley

How to Trade Gold

Most Read: Silver Tumbles Back Into Multi-Month Support Zone

Last Friday’s disappointing US data releases sent gold spinning higher and back to levels last seen back in December last year. The US ISM manufacturing PMI missed market forecasts by a wide margin, and remained in contraction territory, with new orders falling from 52.5 in January to 49.2 in February. The Michigan Consumer Sentiment report also disappointed, missing both last month’s reading and market forecasts, again by a margin.

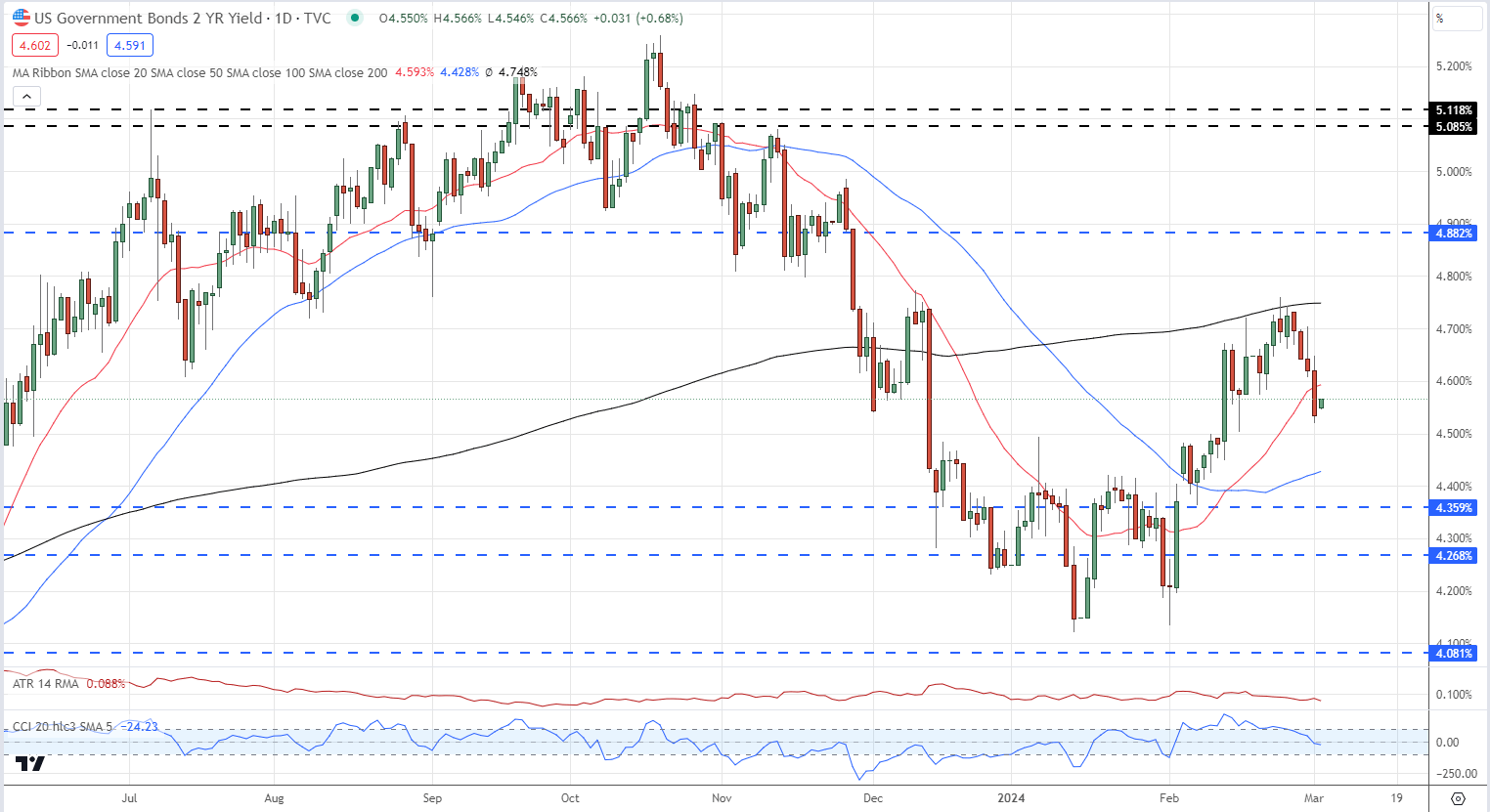

These two releases pushed US rate cut expectations marginally higher and sent short-dated US Treasury yields sliding. Market forecast pushed total rate cut expectations for 2024 to 88 basis points, from 83 pre-data, while two-year US Treasury yields fell by around 10 basis points to 4.52%.

US Treasury 2-Year Yield

Ahead this week there are a few potentially market-moving data releases and events that need to be monitored. Fed chair Jerome Powell’s two-day testimony starts on Wednesday, the same day as noteworthy US ADP and Jolts data hits the screen. To end the week the monthly US Jobs Report (NFP) is released at 13:30 UK and will guide the dollar going into the weekend.

For all market-moving economic data and events, see the DailyFX Economic Calendar.

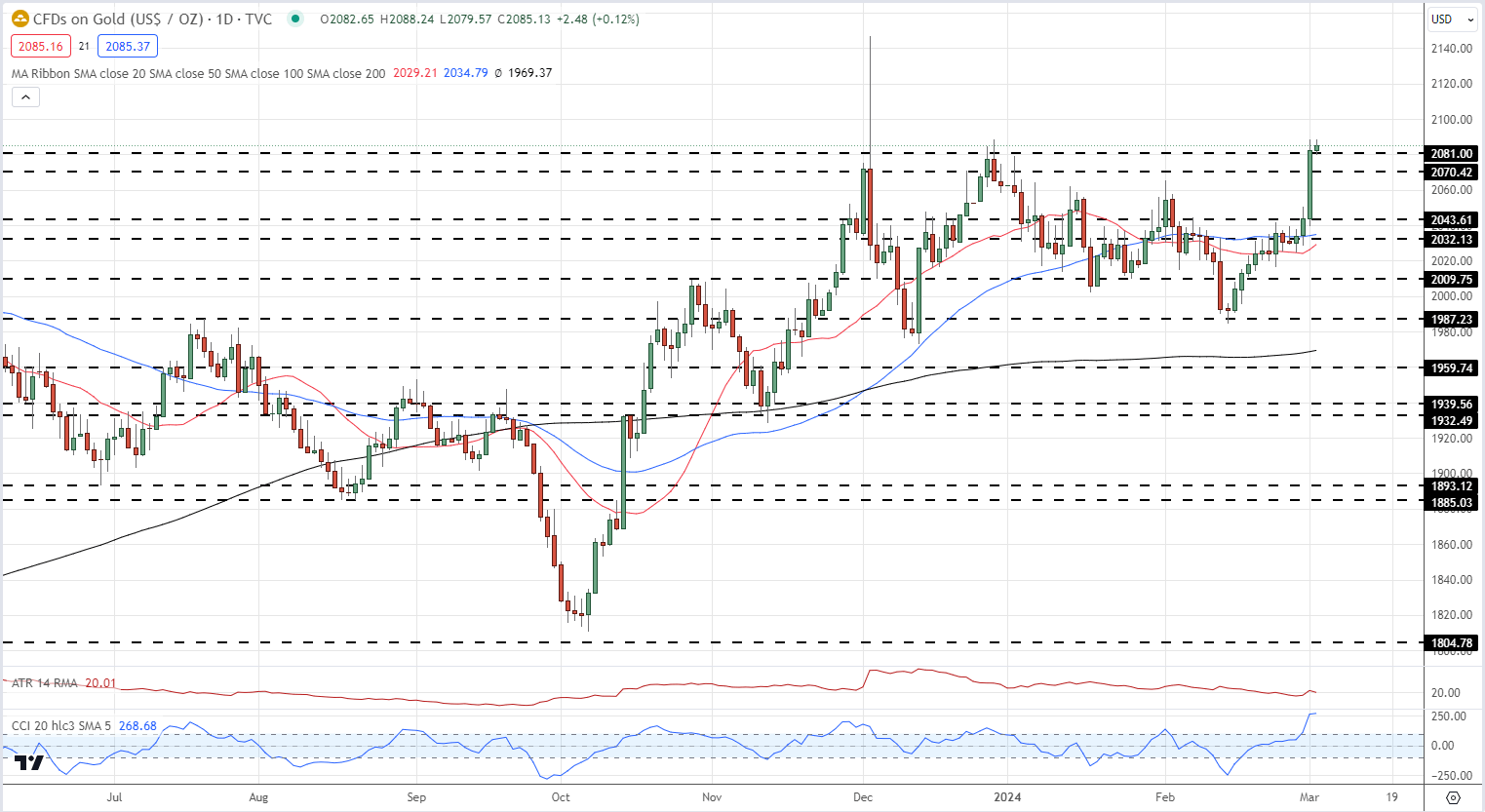

This move lower in US bond yields gave gold a push higher, helping it push through prior levels of resistance and back to highs last seen in December last year. The first of these resistance levels, $2,070/0z. will now start to act as support ahead of $2,043/oz. There is little in the way of resistance between the current spot price and the December 4th spike high at $2,146.8/oz. apart from one technical indicator that is flashing a heavily overbought signal. The CCI indicator, at the bottom of the chart, is now showing an extreme reading over 250 and this is likely to temper any short-term move higher. In the medium- to longer-term, when this reading begins to normalize, then gold is likely to retest the record high seen at the end of last year.

Gold Daily Price Chart

Retail trader data show 44.64% of traders are net-long with the ratio of traders short to long at 1.24 to 1.The number of traders net-long is 5.91% higher than yesterday and 19.58% lower than last week, while the number of traders net-short is 8.05% higher than yesterday and 44.53% higher than last week.

See what these swings in positioning mean for the price of gold

| Change in | Longs | Shorts | OI |

| Daily | 7% | 14% | 11% |

| Weekly | -20% | 50% | 8% |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.