The year is working to an end, but before markets slow to a trickle next week, there was one more key economic release today. The headline and core PCE data – the favored inflation quide for the Fed – was released at 8:30 AM ET, and it showed a lower than expected gain of 0.1% for the core measure (0.2% was expected) and -0.1% for the core measure (0.0% expected). The YoY measures for core and headline were also lower at 3.2% and 2.8% respectively (vs 3.3% and 3.0% expected). The decline of -0.1% was the first since April 2020.

Looking at the last 6 months of the core PCE annualized, it rose by 1.9%, which suggests the Fed is on it’s way to getting inflation down toward it’s 2.0% target.

Another key release today was the Michigan Final consumer sentiment which saw a rise to 69.7 from 69.4 preliminary and 61.3 last month. For the year, the high reached 71.6 in July, before moving down to 61.3 in November. Rates moving lower and sharply lower oil prices have put the consumer in better spirits to end the year. Also within the report is the confirmation of the 1 year inflation expectations at 3.1%. That was equal to the preliminary estimate and well off the 4.5% in November.

Not so robust today was new homes sales which came lower than expectations at 0.590M annualized rate, the lowest level since November.

In the markets, the data sent yield lower, but the longer ended up backing up and closing marginally higher. Looking at the levels at the end of day:

- 2-year yield 4.3294% down -2.0 basis points. It traded down -3.7 basis points at the low. For the trading week, the 2 year fell -12.2 basis points

- 10-year yield 3.9006%, up 0.7 basis points. It traded down -4.4 basis points at the low for the day. For the trading week, the 10-year yield fell -1.2 basis points

- 30-year yield 4.05%, up 1.9 basis points. It traded down 4.0 basis points at the low for the day. For the trading week, the 30 year yield rose 4.2 basis points

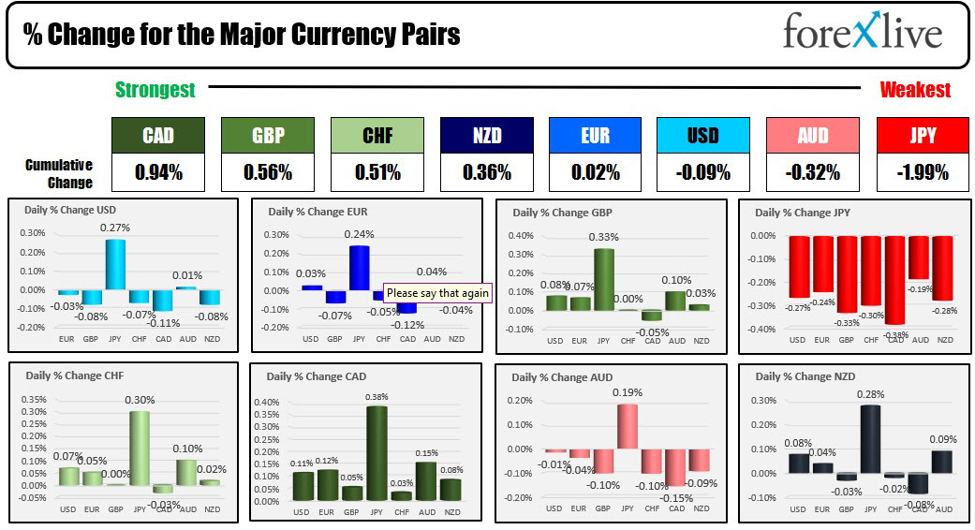

IN the forex market, the major indices are ending the day scrunched together and little changed. The CAD is ending the day as the strongest of the major currencies while the JPY is the weakest, but trading was quiet with little in the way of a definitive price trend. Most of the pairs saw up-and-down price action (or down-and-up).

The strongest to the weakest of the major currencies

US stocks closed mixed on the day but the major indices were all higher for their 8th consecutive week.

- Dow industrial average fell -0.05% on the day but managed to close up by 0.22%

- S&P rose 0.19% on the day, and closed up 0.75% for the week

- Nasdaq closed up 0.19% on the day and rose 1.21% for the week.

The small-cap Russell 2000 led the charge for the day and the week with a gain of 0.84% on the day and +2.46% for the week. In December, the index is now up 12.434% accounting for most of the index’s 15.48% gain for the year.

Forexlive will have limited service next week as we celebrate Christmas and New Years. Let me take this opportunity to thank all so you for your support in 2023. We all look forward to another profitable and helpful year in 2024.

Peace on earth. Goodwill to all.