Markets Week Ahead: Fed and BoE Decisions, US Jobs Data, Microsoft, Apple, Amazon Report

The last week of January is traditionally very busy and this year is no different. The economic calendar is packed full of market-moving events including the latest Federal Reserve and Bank of England monetary policy decisions, US nonfarm payrolls, the first look at German and Euro Area Q4 growth, Chinese manufacturing and services PMIs, and German and Euro Area inflation data, to mention just a few.

For all market-moving economic data and events, see the DailyFX Calendar

Download our complimentary Q1 Equities guide:

Recommended by Nick Cawley

Get Your Free Equities Forecast

In addition to the economic calendar, a raft of US big tech companies release their latest Q4 results. On Tuesday, Alphabet (GOOG) and the world’s largest company Microsoft (MSFT) open their books, while on Thursday, three more of the Magnificent Seven, Amazon (AMZN), Apple (APPL), and Meta Platform (META) release their earnings after the market has closed.

For all earnings releases, see the DailyFX Earnings Calendar

US equity markets continue to make fresh multi-year/decade/all-time records as investors remain firmly risk-on. The upcoming Big 7 earnings release will weigh on the indices, due to their heavy weighting, leaving markets at risk. Last week Tesla (TSLA) disappointed the market and slumped by around 12% after their earnings were released.

Recommended by Nick Cawley

Trading Forex News: The Strategy

Tesla Daily Price Chart

ECB Leaves Interest Rates Unchanged, EUR/USD Listless Ahead of Press Conference and US Q4 GDP

The Euro came under pressure last week despite the ECB leaving all monetary policy settings untouched. The markets are looking at Germany and the Euro Area and are now aggressively pricing in a series of interest rate cuts as economic growth in the region flatlines. Next week’s Euro Area and German GDP data will be closely monitored by the ECB and the market.

Recommended by Nick Cawley

Get Your Free EUR Forecast

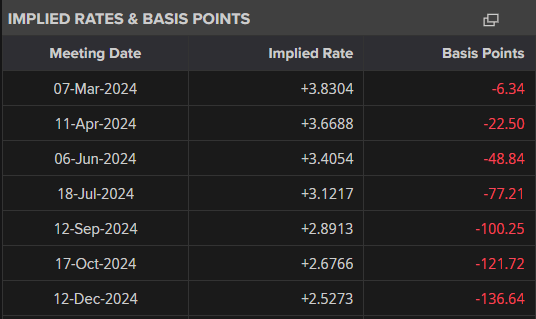

Euro Rate Probabilities – Are Six 25bp ECB cuts on the cards?

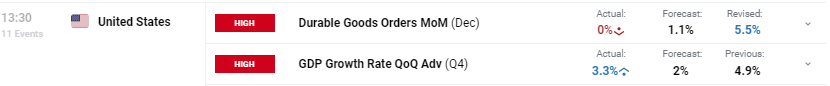

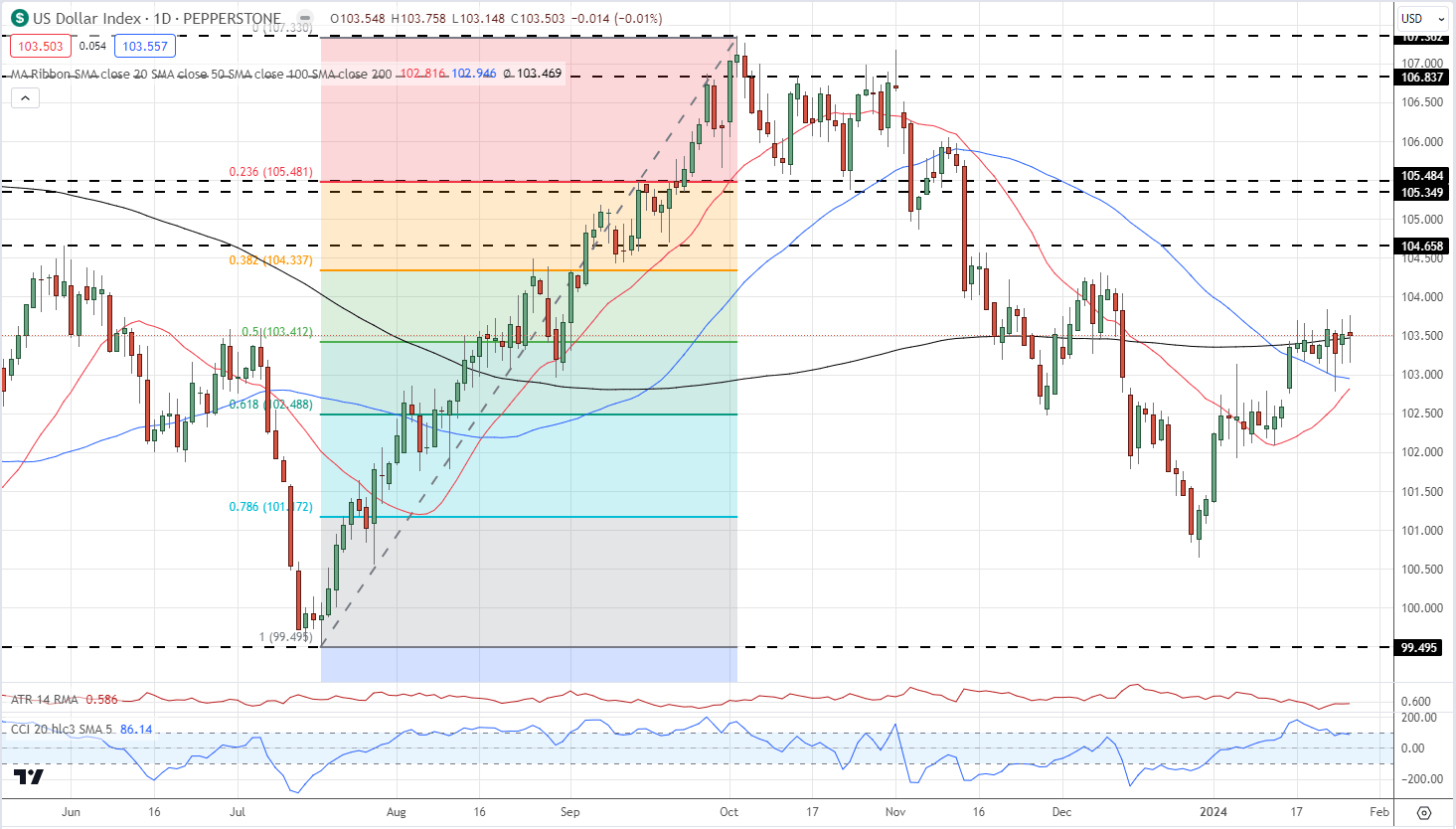

The US dollar remains in focus but last week’s price action was listless. The US dollar index closed within a handful of pips of where it opened the week, despite a slightly better-than-expected US Core PCE report, and a robust advanced Q4 GDP release.

US Dollar Index Daily Chart

Download our latest Q1 US Dollar Techincal and Fundamental Forecasts:

Recommended by Nick Cawley

Get Your Free USD Forecast

Technical and Fundamental Forecasts – w/c January 22nd

Gold Price Forecast: Fed Decision to Guide Trend, Critical Levels for XAU/USD

This article focuses on gold’s technical outlook, examining important price thresholds that traders may find relevant in the coming days.

US Dollar Forecast: USD at the Mercy of the Fed, BoE and NFP Ahead

The US dollar has benefitted from cooling Fed cut expectations and robust economic data. The greenback’s rise appears likely to continue in a data-heavy week.

Euro (EUR/USD) Weekly Outlook: Important GDP, Jobs and Inflation Data on the Docket Next Week

After a neutral ECB meeting on Thursday, next week sees some heavyweight EU economic data hit the screens including GDP, Inflation, and Jobs.

British Pound Weekly Forecast: Could BoE Sound More Comfy With Rate Cuts?

The Pound and the Dollar will both look to their respective central banks this week. Market rate pricing probably poses the biggest risk.

All Articles Written by DailyFX Analysts and Strategists