AUD/USD ANALYSIS & TALKING POINTS

- Aussie stays bid despite solid US retail sales.

- Australian and US PMI’s in focus tomorrow.

- AUD/USD breakout may be short-lived as bearish divergence comes into play.

Elevate your trading skills and gain a competitive edge. Get your hands on the AUSTRALIAN DOLLAR Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar saw a massive uptick as the pro-growth currency capitalized on the Federal Reserve’s interest rate decision yesterday. The announcement to hold rates was not unexpected but the dovish tone by Fed Chair Jerome Powell came as a surprise. Perhaps the signs were there when the Fed’s Waller shifted his outlook recently but with the rate of disinflation slowing, I expected some pushback to the current dovish market pricing. This may be the Fed’s way of engineering a soft landing as opposed to being overly restrictive for too long. That being said, timing will be key moving forward in terms of rate cuts and scale as prices can easily blowout once again thus undoing much of the central bank’s efforts to bring down inflationary pressures in the US. The announcement subsequently rippled across financial markets and rate expectations including the Reserve Bank of Australia (RBA) where cumulative rate cuts in 2024 now stand around the 50bps mark.

Earlier this morning, Australian labor data showed some resilience which strengthened the Aussie dollar despite the uptick in the unemployment rate which reached yearly highs. US retail sales data then pushed back to the Fed’s dovish narrative by beating forecasts suggesting that consumers are still prepared to spend in the current tight monetary policy environment. Tomorrow’s Australian PMI, US PMI and US industrial production data will close out the trading week but is unlikely to move the needle too far as markets continue to digest the recent shift by the FOMC.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

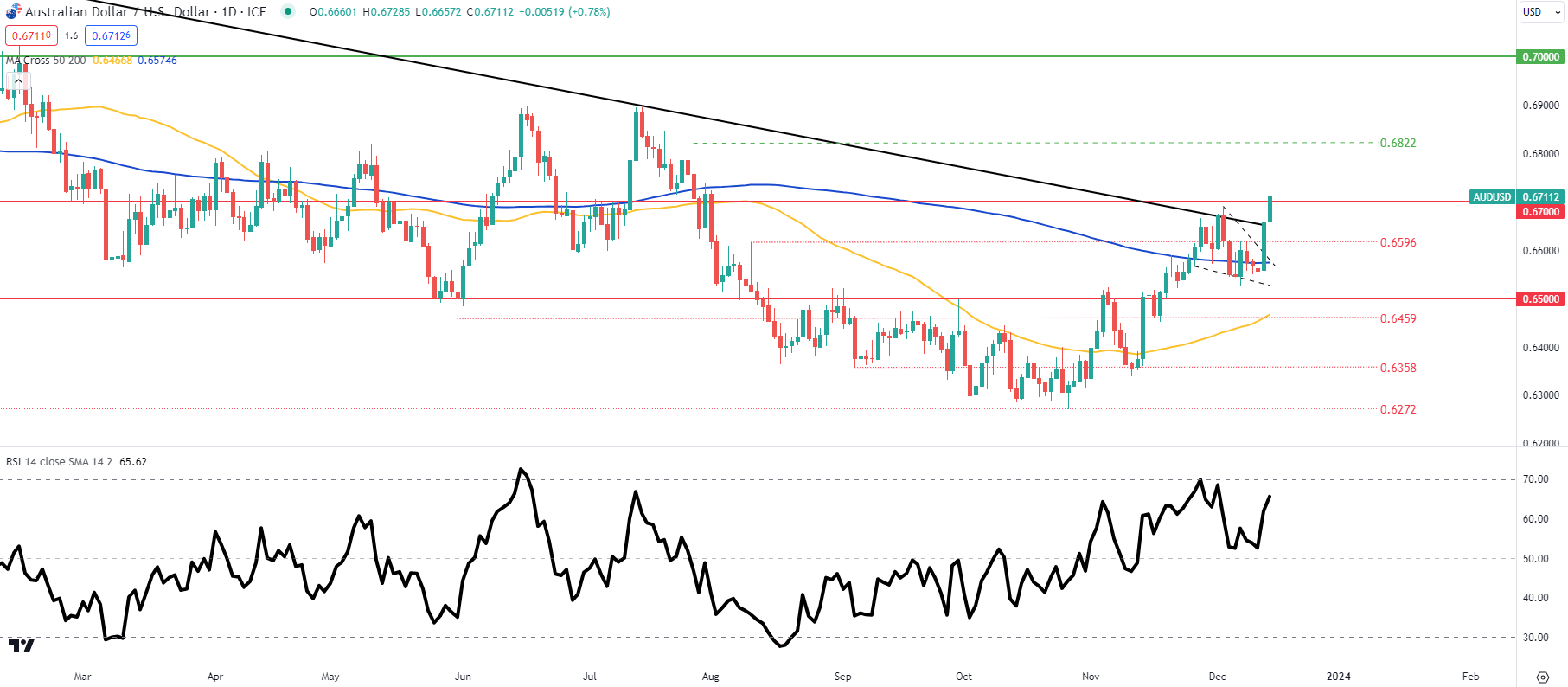

AUD/USD daily price action above has broken above both the falling wedge pattern (dashed black lines) and the long-term trendline resistance (black) zone with the pair now peeking above the 0.6700 psychological handle for the first time since August. A confirmation close above this level could prompt a move higher towards the 0.6822 swing high. That being said, the Relative Strength Index (RSI) indicates bearish/negative divergence by the lower highs, and may lead to a weekly close back below trendline resistance.

Key support levels:

- 0.6700

- Trendline resistance

- 0.6596

- 200-day MA

- 0.6500

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net SHORT on AUD/USD, with 53% of traders currently holding SHORT positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

| Change in | Longs | Shorts | OI |

| Daily | -29% | 39% | -4% |

| Weekly | -27% | 38% | -3% |

Contact and followWarrenon Twitter:@WVenketas