- The Japanese Yen attracts buyers for the second successive day amid renewed intervention fears.

- Geopolitical tensions further benefit the safe-haven JPY and exert pressure on the USD/JPY pair.

- The BoJ rate hike uncertainty might cap gains for the JPY ahead of Japan’s snap general election.

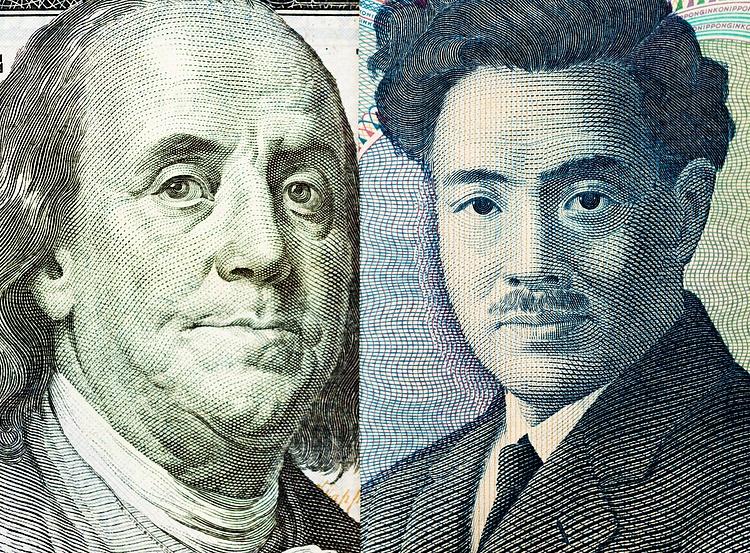

The Japanese Yen (JPY) builds on the overnight bounce from its highest level since August 16 and strengthens for the second straight day against its American counterpart on Tuesday. The overnight comments by Japanese officials fueled speculations that the government might intervene in the FX market to support the domestic currency. Apart from this, geopolitical risks benefit the safe-haven JPY, which, along with a modest US Dollar (USD) downtick, drags the USD/JPY pair to the 147.50 area during the Asian session.

That said, diminishing odds for another interest rate hike by the Bank of Japan (BoJ) in 2024 might hold back the JPY bulls from placing aggressive bets. Furthermore, the upbeat US jobs report released on Friday forced investors to scale back expectations for a more aggressive policy easing by the Federal Reserve (Fed), which should act as a tailwind for the buck and help limit losses for the USD/JPY pair. This, in turn, makes it prudent to wait for strong follow-through selling before positioning for any meaningful depreciating move.

Daily Digest Market Movers: Japanese Yen benefits from intervenetion fears, haven flows

- Japan’s Vice Finance Minister for International Affairs Atsushi Mimura warned against speculative moves in the FX market, fueling speculations that the government may intervene to support the Japanese Yen.

- Adding to this, Japan’s newly appointed Finance Minister Katsunobu Kato said the government would monitor how rapid currency moves could potentially impact the economy and would take action if necessary.

- Furthermore, fears that Middle East tensions could turn into a wider conflict, which drives haven flows towards the JPY and drags the USD/JPY pair away from its highest level since August 16 touched on Monday.

- In the latest developments, Lebanon’s Hezbollah fired rockets at Israel’s port city of Haifa and a military base near the central city of Tel Aviv, while Israel bombed a couple of buildings in the southern suburbs of Beirut.

- China’s state planner – the National Development and Reform Commission (NDRC) – said this Tuesday that the downward pressure on China’s economy is increasing, tempering investors’ appetite for riskier assets.

- The recent comments by Japan’s Prime Minister Shigeru Ishiba, saying that the country is not in an environment for more rate increases, raised doubts over the Bank of Japan’s ability to tighten further in the coming months.

- This, along with the uncertainty over the Japanese general elections on October 27, might act as a headwind for the JPY and offer support to the USD/JPY pair amid a short-term bullish tone around the US Dollar.

- Against the backdrop of Federal Reserve Chair Jerome Powell’s hawkish remarks, the upbeat US jobs report dashed hopes for a more aggressive policy easing and kept the USD bulls elevated near a multi-week top.

- Traders now look forward to the release of the FOMC minutes on Wednesday and the key US inflation data – the consumer inflation figures and the Producer Price Index (PPI) on Thursday and Friday, respectively.

Technical Outlook: USD/JPY dip-buying should help limit losses, 147.00 holds the key for bulls

From a technical perspective, last week’s break above the 50-day Simple Moving Average (SMA), for the first time since mid-July, and the subsequent move beyond the 38.2% Fibonacci retracement level of the July-September downfall were seen as fresh triggers for bulls. Moreover, oscillators on the daily chart have been gaining positive traction and suggest that the path of least resistance for the USD/JPY pair is to the upside. Hence, any further slide might still be seen as a buying opportunity and is more likely to remain cushioned near the 147.00 mark, which should now act as a key pivotal point.

On the flip side, a sustained move back above the 148.00 mark might prompt some technical buying and lift the USD/JPY pair to the 148.70 resistance zone en route to the 149.00 round figure. Some follow-through buying beyond the weekly top, around the 149.10-149.15 region, will reaffirm the positive outlook and allow bulls to reclaim the 150.00 psychological mark.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.