The European Central Bank (ECB) and the Bank of England (BoE) are both expected to maintain their current interest rates without any significant changes. ECB officials are generally leaning towards keeping rates stable, and the likelihood of a rate cut in the near future is low. In the central scenario, interest rates are expected to remain unchanged through the first half of next year.

In the UK, there is a higher likelihood of an interest rate increase due to persistent inflation. However, the possibility that rates have already reached their peak is also becoming more likely as economic growth slows down.

The upcoming ECB meeting is not anticipated to bring any major surprises, and the central bank is expected to keep its official rates steady. Those hoping for a more dovish stance may be disappointed, as the ECB could maintain a hawkish hold that leaves room for potential future rate hikes. The central scenario suggests that rates may have peaked, but recent increases in oil prices and developments in the Middle East have created additional uncertainty, which may lead the ECB to keep its options open. Even the more dovish members of the ECB are not pushing for rapid rate cuts, and it’s probable that rates will remain stable through the first half of next year.

ECB Chief Economist Lane, despite not being one of the more hawkish members, has emphasized that the ECB is still a distance away from achieving its goals and needs to monitor wage agreements. He also mentioned that the ECB can only consider normalizing its policy when it is confident that inflation will slow down to 2%. The majority within the ECB appears to want to wait until the March 2024 projections before removing the tightening bias, which the more hawkish members wish to maintain for now.

Governing Council member Holzmann expressed concern about inflation and suggested that further shocks might necessitate additional rate increases. At the moment, these shocks are most likely to arise from higher energy prices, and ECB President Lagarde has mentioned that the central bank is monitoring the oil price for potential inflationary impacts arising from the Israel-Hamas conflict.

The ECB’s latest inflation forecast predicts that the Consumer Price Index (CPI) will decrease to 2% in 2025, assuming a decline in oil prices. However, in the current situation, there are upward risks to this forecast, primarily due to higher energy prices, which are also putting pressure on economic growth.

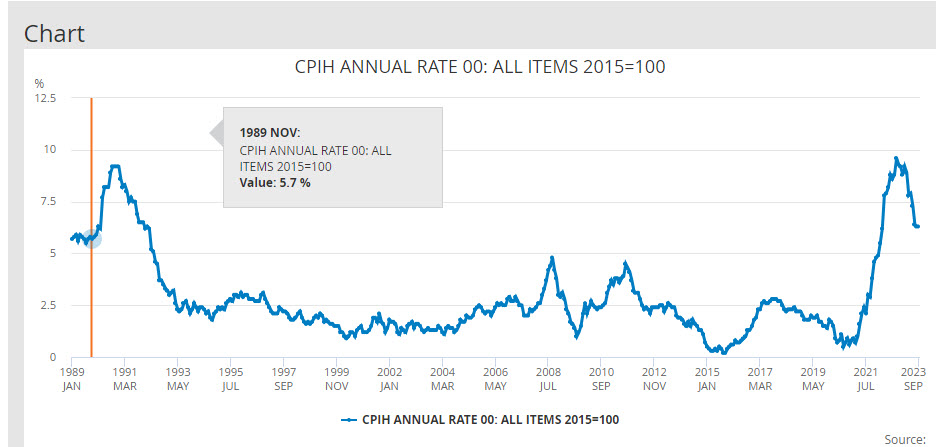

In the UK, despite higher-than-expected inflation and strong wage figures, these factors alone are not likely to prompt another rate hike at the upcoming meeting. There is a significant chance that interest rates in the UK have already peaked. Officials are cautious about interpreting the signals from wage data, and confidence indicators suggest a cooling labor market. Even though UK headline inflation remained high in September, it is expected to drop significantly in October when the impact of last year’s energy price surge is no longer factored into the calculations.

The Bank of England expects inflation to average around 4.3% in the first quarter of 2024. While the bank’s recent track record on inflation projections has not been perfect, it is likely that inflation has already reached its peak and will gradually decrease. However, there are still upside risks, particularly in service price inflation.

The Bank of England expects inflation to average around 4.3% in the first quarter of 2024. While the bank’s recent track record on inflation projections has not been perfect, it is likely that inflation has already reached its peak and will gradually decrease. However, there are still upside risks, particularly in service price inflation.

The labor market, which saw a significant rise in wages over the past year, is showing signs of cooling, and hiring has slowed. Companies are becoming more reluctant to hire due to rising cost pressures, which could limit wage growth in the coming months.

In summary, the ECB is expected to keep rates unchanged, and the focus will be on President Lagarde’s statement and press conference, with attention to the recent rise in oil prices and reinvestment of assets. In the UK, despite high inflation and strong wage data, another rate hike is not expected at the next meeting, and there is a growing belief that rates have already peaked.

However, some upside risks remain, particularly in service price inflation. The labor market is showing signs of cooling, which could affect wage growth. The majority of members in both central banks do not appear to favor rate cuts, and the possibility of further rate hikes remains open, although there is a recognition of the subdued economic outlook.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.