USD/JPY ANALYSIS & TALKING POINTS

- Moderating Japanese inflation keeps JPY on offer heading into next week.

- US inflation, GDP and durable goods under the spotlight this week.

- Bearish divergence conflicts with ascending triangle pattern on daily chart.

Supercharge your trading prowess with an in-depth analysis of the Japanese Yen outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen is yet again at the border of the significant 150 level after comments from Bank of Japan (BOJ) Governor Ueda made several cautious statements (see below) but one in particular stood out on monetary policy. He reiterated the continued implementation of accommodative monetary policy to reach their inflation goals after Japanese inflation softened on all metrics including both core and headline prints. This weighed negatively on the yen and against a backdrop where the US dollar is marginally on offer.

“Uncertainty surrounding Japan’s economy is very high.”

“The BoJ will aim at stably and sustainably achieving the 2% inflation target, accompanied by wage growth, by patiently maintaining the current easy policy.”

“We must carefully watch financial and FX market moves, along with their impact on Japan’s economy and prices.”

That being said, energy prices have been on the rise and could have an upside influence on inflation going forward. Money markets currently forecast an interest rate hike around July/September 2024 and with wages showing marked increases, there may be a less dovish outlook to come from the BoJ should these data points continue their current trajectory.

BANK OF JAPAN INTEREST RATE PROBABILITIES

Source: Refinitiv

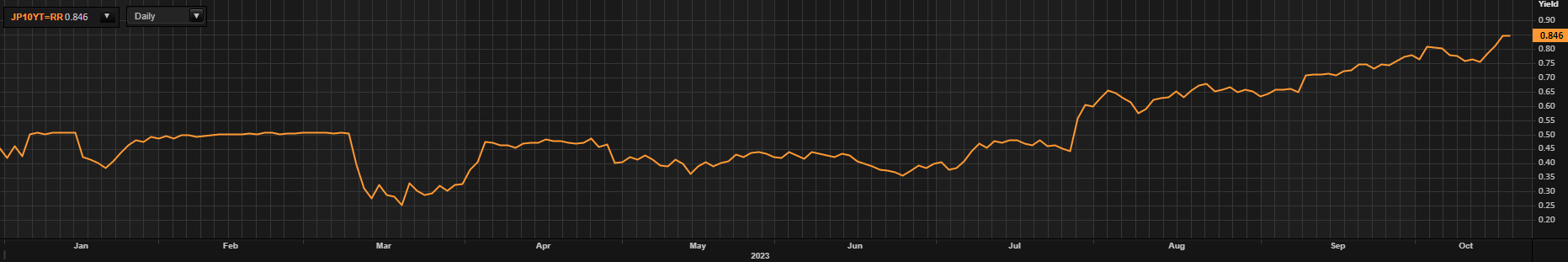

Looking at the 10-year JGB below, the yield is steadily approaching the 1% cap as per the yield curve control guidelines. The BoJ will be keeping a close eye on this metric to avoid any rapid rally higher.

10-YEAR JAPANESE GOVERNMENT BOND

Source: Refinitiv

With rising tensions in between Israel-Hamas, the safe haven allure of the yen has been temporarily overshadowed by the aforementioned dovish remarks but intervention around these levels could be on the cards.

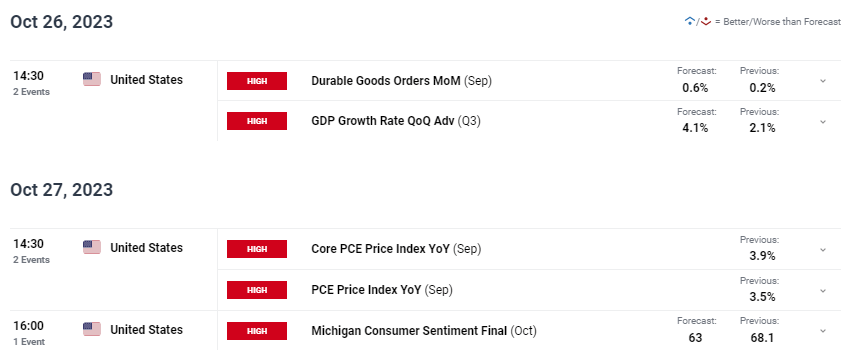

The week ahead will be focused mostly on US specific factors but the Fed’s preferred measure of inflation (PCE price index) will carry the most significance. Other key data includes durable goods orders, Michigan consumer sentiment and GDP.

USD/JPY ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/JPY TECHNICAL ANALYSIS

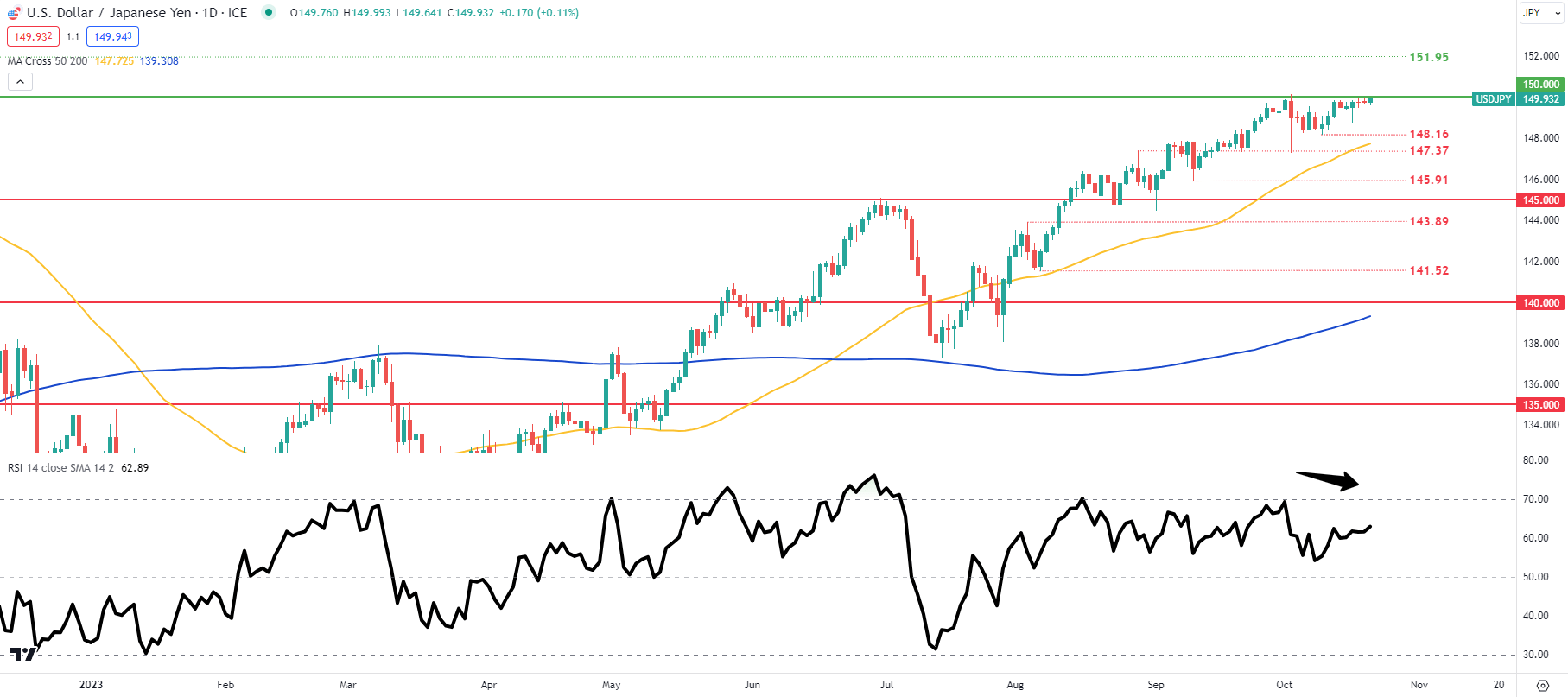

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/JPY price action resembles an ascending triangle formation with resistance at the 150.00 psychological handle. Traditionally, a bullish signal but with the Relative Strength Index (RSI) exhibiting lower highs, bearish/negative divergence could suggest a possible pullback lower.

Key resistance levels:

Key support levels:

- 148.16

- 50-day moving average (yellow)

- 147.37

- 145.91

- 145.00

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently net SHORT on USD/JPY, with 86% of traders currently holding short positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas