Euro (EUR/USD, EUR/GBP) Analysis

Markets Await the Fed’s Summary of Economic Projections for Clues

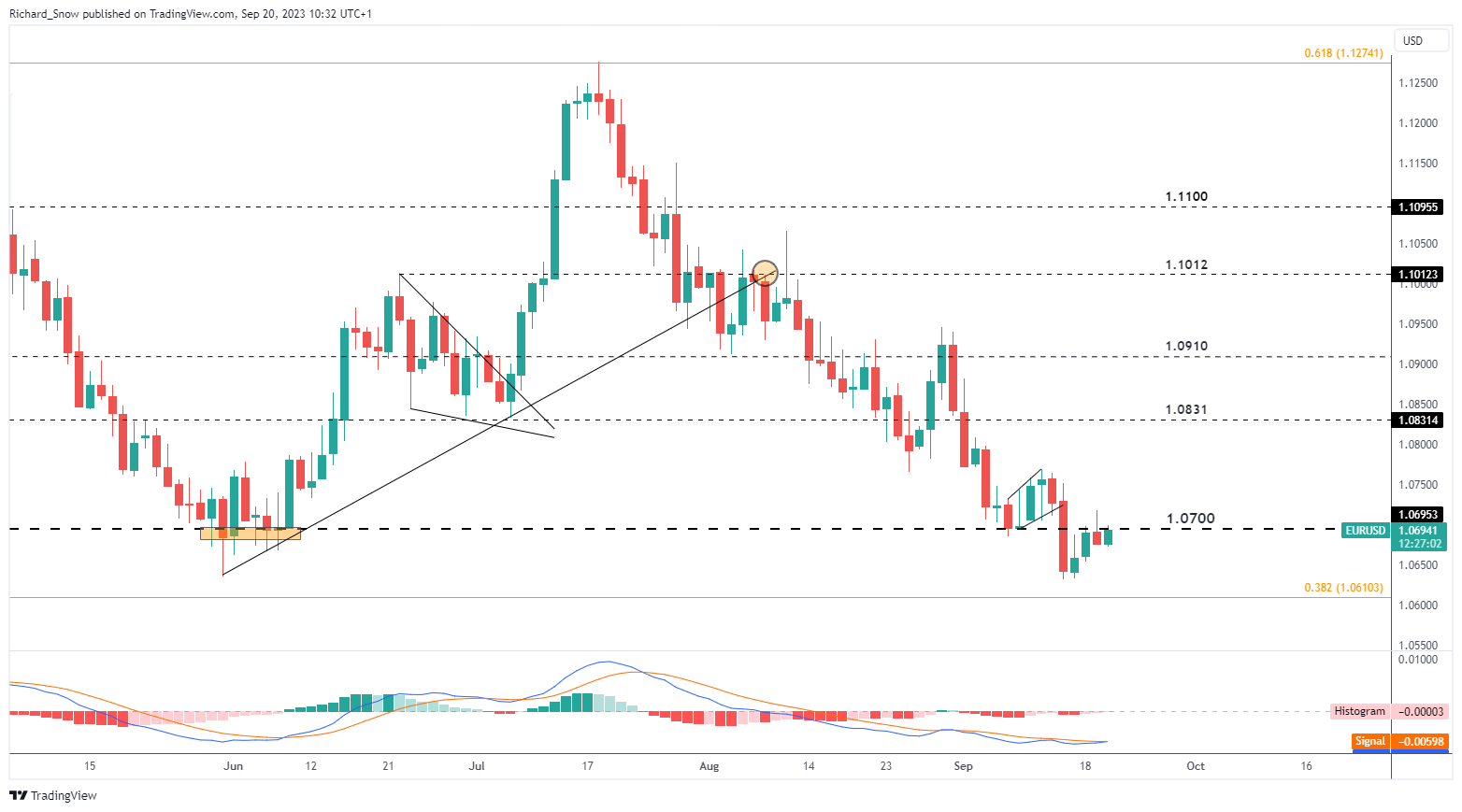

The euro has recovered a large portion of losses against the dollar, as markets look to the updated quarterly forecasts known as the summary of economic projections for clues. EUR/USD dropped immediately after the ECB decided to hike interest rates, for possibly the last time, to 4%.

The bearish move was a continuation of a prior channel break (seen on the weekly chart below) that now highlights the 1.0640 mark as support.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

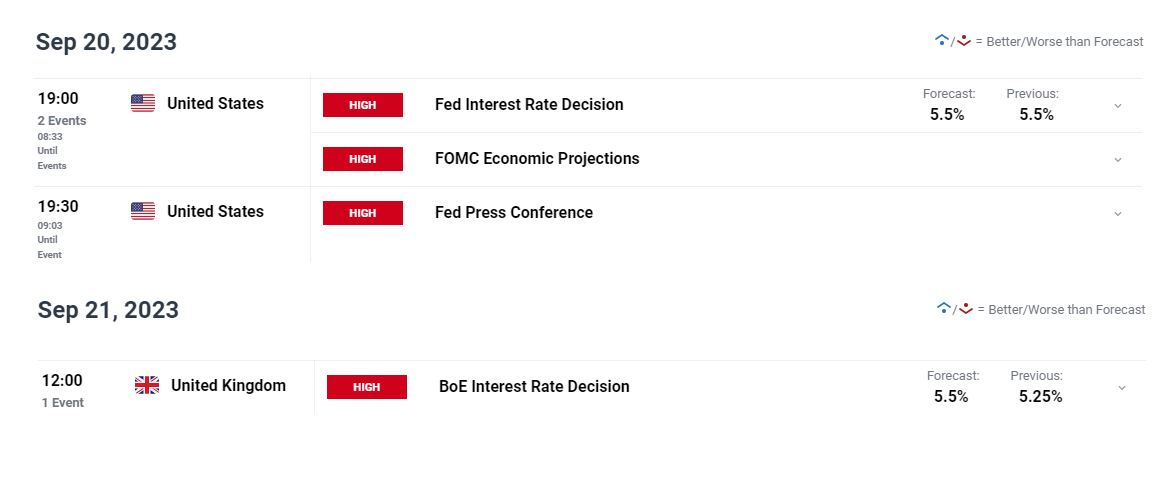

Growth, Peak Rates and Inflation Forecasts to Set the Tone for Q4

Growth, the peak interest rate, and inflation forecasts will be scrutinized by market participants this evening. The US economy has been in cruise control, requiring an upward revision in expected GDP growth in the June release and there could very well be another on the way.

Any material change in the dot plot ought to be felt across FX markets as the Fed will ponder whether the option of one more quarter point hike will be enough considering the newest threat to inflation – the surging oil market.

Markets will also look to inflation forecasts in 2025 and the ‘long-run’ time frame for evidence of entrenched inflationary pressures that may become the norm moving forward. Should this materialize it suggests interest rates will need to remain higher for longer in the US – weighing on EUR/USD.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

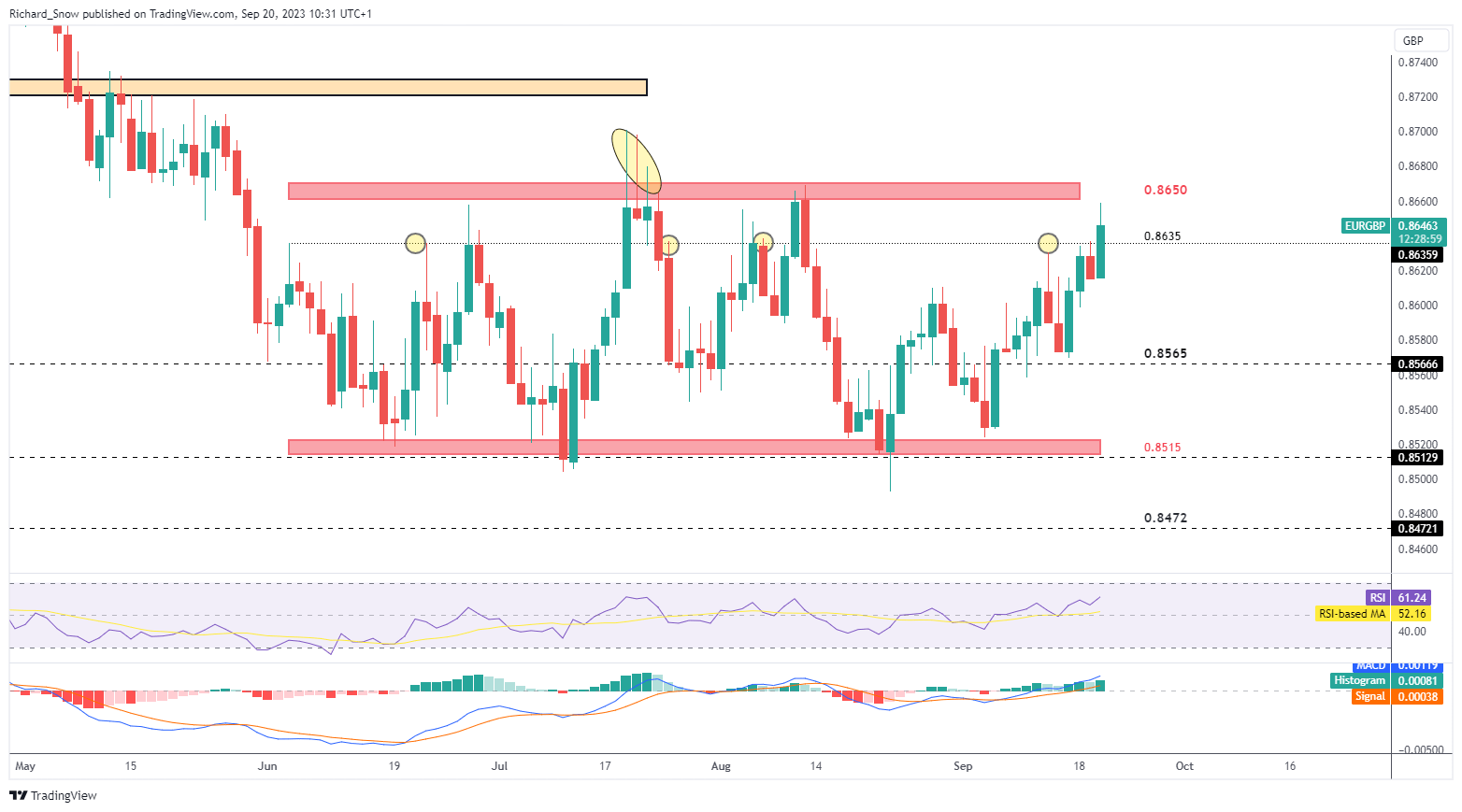

Inflation Progress Throws BoE Decision Wide Open, EUR/GBP Tests Range

The Bank of England (BoE) had been shaping up to be a straightforward one before today’s inflation data suggested that prior tightening is finally starting to yield positive results. Both core and headline inflation came in lower than expected, providing the BoE’s monetary policy committee with a potential reason to hold rates steady. Read the UK CPI report for more details.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare and trade around high impact news by reading the guide below:

Recommended by Richard Snow

Trading Forex News: The Strategy

EUR/GBP currently tests the upper bound of the broad range (0.8650) as sterling comes under pressure. Both the euro and pound sterling have struggled to see periods of prolonged strength against G7 currencies, making them ideal candidates for ranging conditions when viewed as a pair.

Should the BoE hold rates tomorrow, the range could come under pressure with EUR/GBP possibly breaching channel resistance. Currently, according to rates markets, there is great potential for repricing as half the market still expects another hike.

In the event the bank does hike, sterling may claw back recent losses – extending the trading range. The arguments for and against a hike appear more finely balanced. Elevated wage pressures and surging oil prices point to upside risks to inflation, while an easing jobs market and lower inflation suggest the committee can afford to pause.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the #1 mistake traders make and avoid it! The below data was gathered by thousands of IG live accounts:

Recommended by Richard Snow

Traits of Successful Traders

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX