Australian Dollar Vs US Dollar, Australia Jobs – Talking Points:

- AUD held gains after Australia jobs data beat expectations.

- ?AUD/USD is attempting to form an interim base.

- Speculative short AUD positioning is at the highest level since early 2022.

- What is the outlook for AUD/USD and what are the key levels to watch?

Recommended by Manish Jaradi

How to Trade AUD/USD

The Australian dollar held early Asia gains against the US dollar after the Australian economy created more jobs than expected last month.

The Australian economy created 64.9k jobs in August, compared with forecasts for a gain of 23k, following job losses in July. The unemployment rate remained flat at 3.7%, in line with expectations, just off five-decade lows. The solid jobs number was almost entirely due to part-time employment gains (62.1k), prompting a slight retreat in AUD/USD. Full-time employment rose 2.8k following losses of 24.2k in July.

AUD/USD 5-minute Chart

Chart Created by Manish Jaradi Using TradingView

The Australian jobs market is showing signs of cooling, reducing the urgency to tighten further. Recent Australian data, including GDP, composite, and services PMI, have been encouraging, coming in higher than previous readings.However, the Economic Surprise Index for Australia suggests the data have broadly been underwhelming. Wednesday’s jobs data does little to alter the broader expectations of RBA remaining on hold next month. Market pricing suggests a small possibility of a rate hike in November.

With the broader US inflation trajectory still pointing down, albeit gradually, US Federal Reserve rate expectations remained largely anchored around one more hike in November (about 40% chance) before rate cuts beginning mid-2024. US CPI rose by 3.7% on-year last month, against expectations of 3.6%, well above 3.2% in July. However, core inflation eased to 4.3% on-year from 4.7% previously.

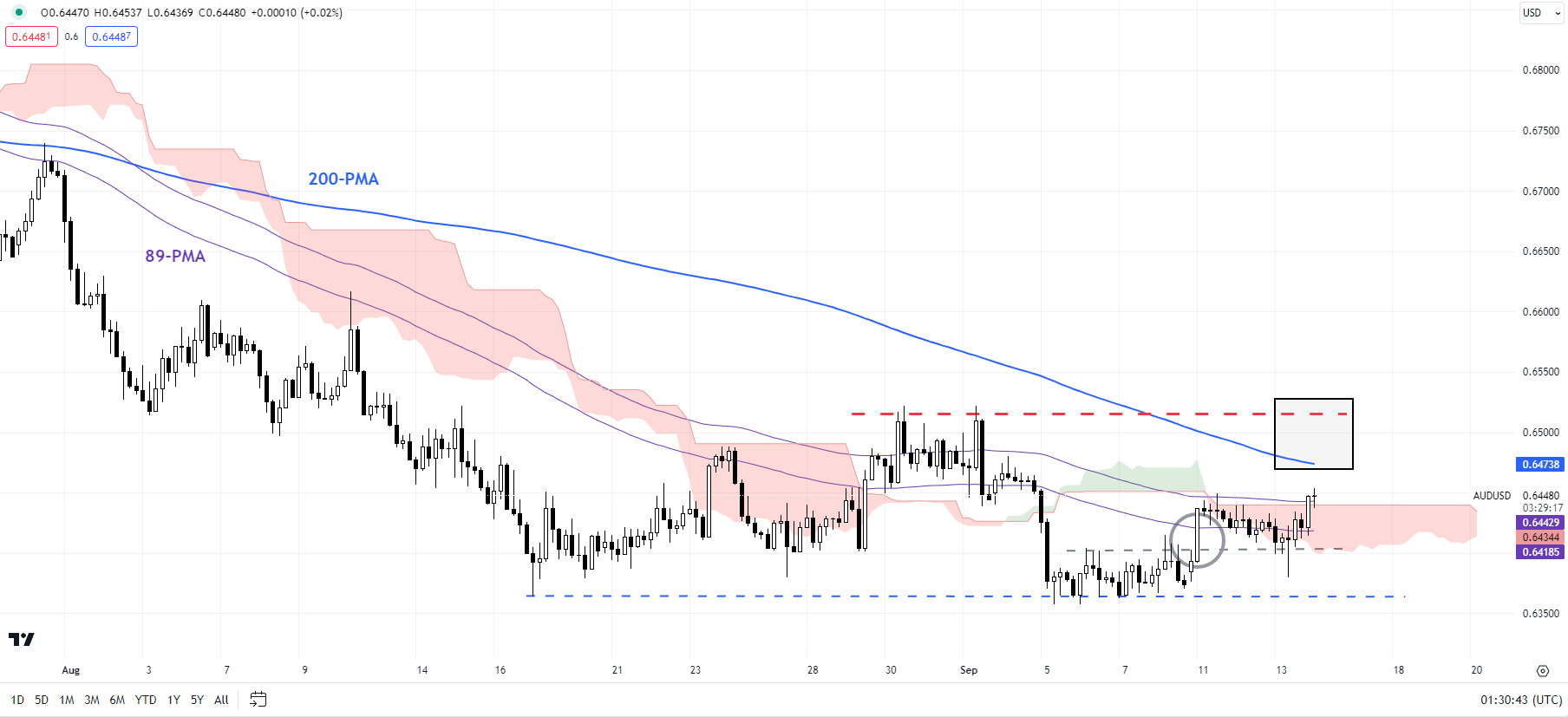

AUD/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

While the rates outlook for both economies remains similar until the year-end, the outperformance of the US economy has pushed up USD globally. In contrast, the outlook for the Australian economy has been deteriorating since the last year. Much would depend on the outlook on the Chinese demand, Australia’s largest export destination. Beijing has announced a spate of support measures/stimulus measures in recent weeks to cushion some of the downside risks, but those measures have yet to translate into an improved outlook for the economy.

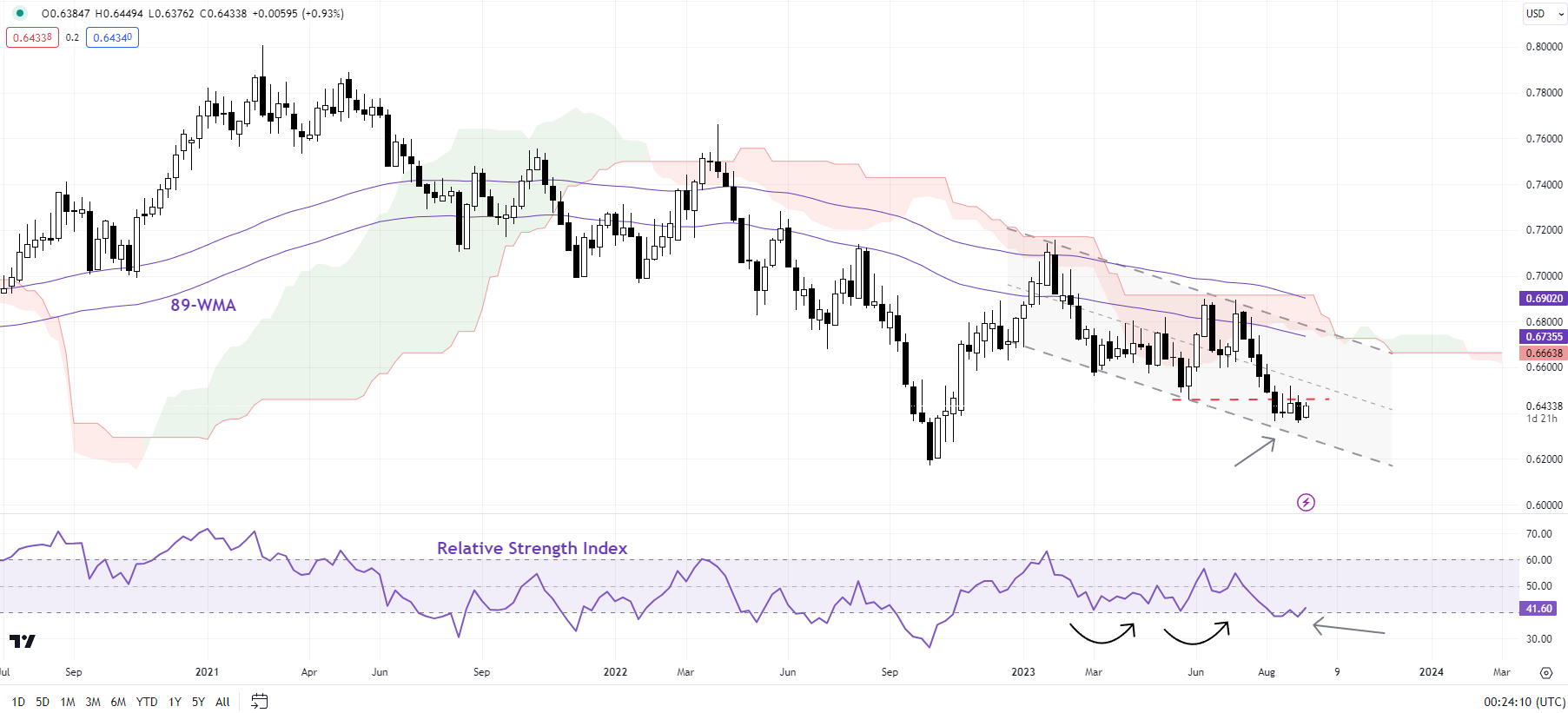

AUD/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Meanwhile, on technical charts, AUD/USD looks oversold as speculative short AUD positioning is at the highest levels since early 2022. The hold in recent weeks around 0.6350, coinciding with the lower edge of a declining channel since March suggests AUD/USD is attempting to form an interim base. This is reinforced by developments on higher timeframe charts – the 14-week Relative Strength Index is near the 40-level, which was associated with a rebound on two occasions in H1-2023.

The rise earlier this week above 0.6400 is an encouraging sign for bulls. Any break above the end-August high of 0.6525 would trigger a minor double bottom (the August and September lows), pointing to gains toward 0.6700.

Recommended by Manish Jaradi

The Fundamentals of Breakout Trading

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish